Do you remember how I love Infographs? Well I think I just found one that YOU may love, ok like.

This is a fun and easy way to display all the great information that NACE uncovered in their recent survey, you can read a more details here if you’d like or just check out some of the highlights below. And make sure to tell us where you are going by filling out our own Internship Survey (it’s short I promise!!!).

Key Findings:

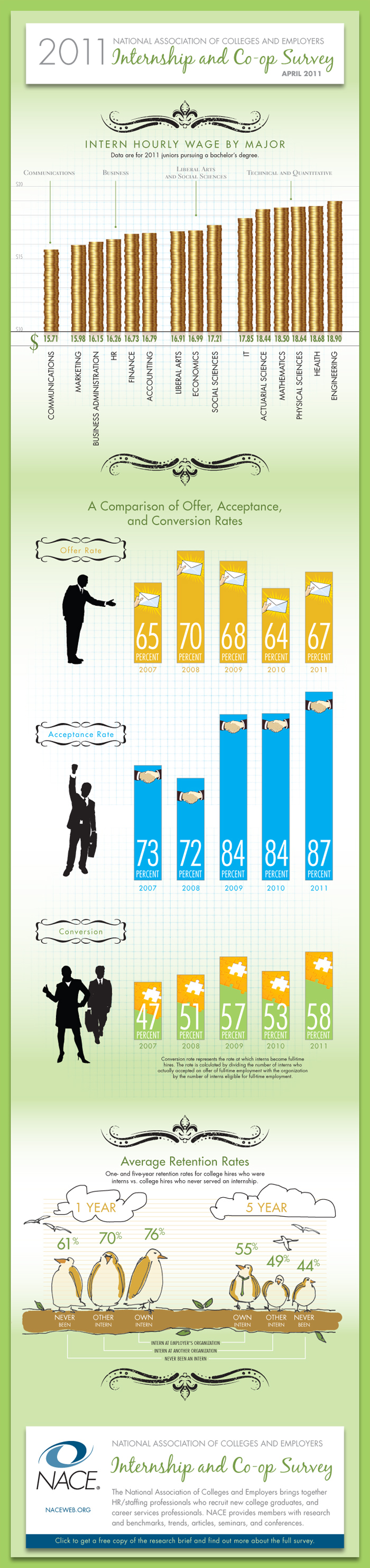

NACE’s 2011 Internship & Co-op Survey indicates that internships are an integral and ever-important part of the college recruiting scene. The survey finds that employers expect to increase internship hiring by about 7 percent this year and co-op positions by nearly 9 percent. Furthermore, they will draw approximately 40 percent of their new college hires for 2011 from their internship and co-op programs. These figures demonstrate the central role that experiential education plays in the overall college recruiting process. The following are additional key findings drawn from the survey.

Hiring

- The number of internships is expected to rise by 6.8 percent in 2011.

- Increases are expected in every region and virtually all industry sectors for which there are data.

- The only industries reporting a significant decline in their expected number of interns are food and beverage manufacturing (down 5.2 percent) and government

(down 6 percent).

- The number of co-ops is expected to increase by 8.6 percent.

- As with internships, the increased co-op hiring is expected to be felt broadly, i.e., across all regions and mostly all industries.

- The only industries expecting to decrease their co-op hiring are construction (-29.5 percent) and government (-4.4 percent).

Recruiting

- Internship and co-op recruiting is primarily “high touch.” There is very little indication that recruiting techniques in this area have changed significantly to incorporate new technologies in identifying and attracting interns and/or co-ops.

- Three recruiting activities dominate the budget allocations for both internship and co-op recruiting—career fairs, on-campus recruiting, and on-campus information sessions.

- Virtually the same activities were judged by respondents to be the most effective in reaching students for internships and co-ops.

- On-campus recruiting and career fairs were the highest-rated activities in terms of effectiveness for both internships and co-ops.

- Referrals from current or former interns was number three in effectiveness in recruiting interns, while developing contacts with key faculty rose to number

three in recruiting co-ops. - Very little budget (1.8 percent) was allocated to online networking for recruiting both interns and co-ops, and it was listed at the bottom in terms of effectiveness as a recruiting activity.

- Three recruiting activities dominate the budget allocations for both internship and co-op recruiting—career fairs, on-campus recruiting, and on-campus information sessions.

- Target schools for recruiting interns and co-ops are chosen for three principal reasons: 1) the academic majors offered at the institution; 2) the perceived quality of the programs from which the recruiter will draw new interns or co-ops; and 3) the employer’s past recruiting experience at the school.

Conversion and Retention

-

The overall conversion rate for interns increased sharply from 53.3 percent last year to 57.7 percent this year.

-

The major reason for the increase in this year’s overall conversion rate was the increased rate at which employers offered their interns full-time positions. That rate increased from 63.3 percent last year to 66.7 percent in this survey.

-

The conversion rate for co-ops is down to 55.5 percent from the 60.4 percent figure recorded last year.

-

The major reason for the decreased conversion rate for co-ops is the decline in the rate at which co-ops were being offered full-time positions.

-

The offer rate for co-ops declined to 63.2 percent from the previous year’s figure of 65.7 percent. This is the fourth consecutive year that the offer rate for co-ops has declined.

-

-

Internships and co-op programs are clearly connected with retention. This year, the differences in retention between new hires with an internship/co-op background and those without such experience are particularly evident.

-

After one year on the job, hires drawn from an employer’s own internship or co-op program were retained at a rate of 75.8 percent. By contrast, 60.7 percent of hires that came on board without any internship/co-op experience were still with the company after one year.

-

At the five-year mark, 55.1 percent of hires coming from an employer’s program were still at the firm while only 44 percent of hires without an internship/co-op experience remained.

-

About the Survey

The 2011 Internship and Co-op Survey was conducted from January 5, 2011, through February 28, 2011. A total of 266 NACE-member employing organizations took part, for a response rate of 30.9 percent.